Product at a glance:

- Product: FamilyMint Money Management Certification Program Booklet + FamilyMint Online App Premium Service for Life

- Publisher: FamilyMint

- Price: Special Introductory offer is $29.99 which includes the workbook PLUS FamilyMint Premium for Life

- Web-site: FamilyMint

- Other Products: They offer the app by itself for $24.99 per year or $4.95 per month. You can also purchase additional workbooks for 1/2 price when you take advantage of the Introductory offer.

- Ages/grades suggested for: Workbook is suggested for Grade 5 & above (ages 10 & up), online app is suggested for ages 6-14 years old.

- What problem does this product solve (from the publisher's site):

- 2 out of 3 high school seniors graduate without knowing the basics of budgeting. 18 to 24 year olds are the fastest growing age group filing for bankruptcy.

- How will this product help solve that problem (from the publisher's site):

- FamilyMint's Money Management Certification Program combines a 60-page step-by-step workbook with a fun online money management application for kids. Kids that complete the 2 month program develop key money habits that will benefit them the rest of their lives. Your kids will form new habits... Tracking their money, Creating SMART goals, Easy budgeting, How interest works, and much more.

_________________________________________________________

For me, the book learning is easy. Math, you bet, I have a book and an outline, I can teach that. English, history, science, yep...there's a book and an outline for that. There are core content guides, Youtube videos, worksheets, books, and plenty of support for teaching those concrete kind of things. But...BUT those aren't the only things I want to make sure my kids learn while I'm homeschooling them. Life skills, critical thinking, home care and economics, self care, planning, money management, fiscal responsibility, and budgeting are all things you don't typically find in a text book.

These things that are conspicuously absent from traditional education. And yet, before organized, government-run schooling, these things were the core of the home educator's curriculum.

When I was but a young lass, I was that over achieving college-bound student. My parents, thinking that letting me focus on my studies would benefit me more than helping out around the house, allowed me lots of time to study, read and learn. They didn't require me to learn cooking, cleaning, laundry, and other household management because they knew I was taking very difficult classes that required a lot of focus and time. In school, my teachers saw the promise in my studious nature and steered me away from electives like "home ec" and "family budgeting" towards additional science and advanced math classes. I did take accounting (which my guidance counselor discouraged) because my family owned a business and I saw that it would be useful. That's the only reason I learned to balance a check book. I don't blame the school or my parents in any way. I was a promising student and they wanted to nurture that promise in the hopes for something better for me. I could have signed up for Home Ec as an elective, I chose not to though. I could have joined my mom in the kitchen and learned cooking or sat with her while she sewed and quilted to learn those skills.

While I excelled at school, I missed out on learning how to organize and maintain a home. I didn't learn to cook or meal plan or sew. When I began a family, I had to learn these things as best as I could in a book or short lessons with my mom. I want my kids to learn those things (as best I can teach them) before they are out in the world by themselves.

My husband and I help my parents run a comic and games store and as such, we work with the public every day. We also have a 23-year-old college student. Every week we watch her and kids close to her age make bad decisions about money. We hear them talk about the debt they have and then hand us a credit card to pay for the luxury items we sell. If you are 22, $8000 in debt, and you haven't been able to afford groceries all week, you shouldn't be putting another $30 on your credit card balance for comic books. They are not a necessity, they do not sustain life, they are a want, not a need!

We want to teach our kids those self-control and planning skills they need to make intelligent money decisions. Having looked for programs about money management at the homeschool conventions the last couple years, we came away empty handed.

All of the above examples are the reasons I was so thrilled to see the chance to review this program when it came across the Mosaic Reviews boards! FamilyMint has put together a short introduction to money management program that a family can work through together. Even though the workbook part of the program is rated ages 10 and up, my 8-year-old is working through it alongside her 11-year-old brother. We haven't made it through the entire book yet, but she's holding her own.

Above are a couple of the workbook pages where Matthew and Emma learned about goal-setting and how to determine if your goal is S.M.A.R.T.

- Is it Specific?

- Is it Measurable?

- Is it Achievable?

- Is it Relevant?

- Is it Time-bound?

The other page helps the kids compares Income and Expenses. My kids do get a weekly allowance. They can also earn money for specific chores and for finishing books (outside of their assigned books for school). They didn't put down birthday and Christmas gifts, but they often get money for those as well.

We all thought the workbook was great. As simple and good as the workbook is, all of us LOVE the web-site app! If you do nothing else in response to this review, check out the free trial of the web app! Link is at the bottom of this page. You get 14 days of using it fully to see if it is a fit for your family.

Honestly, I set up both the 8 and 11-year-old and I may still set up my husband, myself and the 23-year-old. Here are some screen shots from our accounts:

|

| Home screen. Here you see transactions your kids have initiated that need to be approved as soon as you log in. |

|

| Making a deposit You can choose which goal you want to put your money towards |

|

| One of Matthew's goals is to save up to buy the Disney Infinities video games and figures Since it's been pushed back to August, he has a chance to accomplish it. |

|

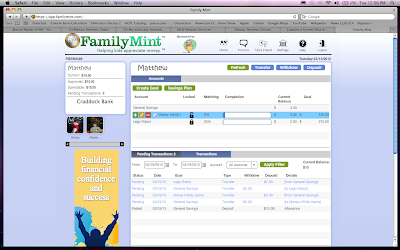

| Matthew's transaction ledger showing debits and credits |

|

| A quick tutorial from the FamilyMint FAQ page. |

The online program let's you set up a family bank and give the kids each accounts. In those accounts, the kids can "deposit" money and set goals. It gives the kids a Savings Plan so that for every dollar they deposit, it divides it automatically into their goal accounts. Here's a screen shot:

As you can see, Matthew has money going into three goals and his savings account. As I said before, he wants to buy Disney Infinities when it releases, then he's saving for a Lego Mindstorms Robot and just this weekend he decided he really wants a Wii U because the new Lego game is only on the Wii U system. I told him he had to start putting money into savings for the future and instead of complaining (like I thought he would) he explained to me that the book used higher percentages for general savings than 10% and we should investigate an interest bearing savings account at a real bank because the bank of mom doesn't really pay interest. Now, Dad and I feel that the Lego Mindstorms Robot is and educational tool as well as a great toy, as such, we are willing to match part of the funds that Matthew puts aside for that goal. If you look at the screen, you can see that we will match his funds for the robot by 20%. When he registers a deposit, that amount is automatically added to the account above what he deposited.

_________________________________________________________

The FamilyMint Money Management Certification Program really covers a lot of ground in a succinct way. It gives kids just starting out a great over view of all the concepts of money management in just two simple months. It comes with a Certificate of Achievement on the back of the book to cut out when you've completed the program. There are dozens of worksheets, practice checks, ledgers, and goal tracking sheets in the back of the book so that the child(ren) can see on paper the concepts they've been practicing on the online app. The Award Winning program has dozens of financial partners that include banks and credit unions all over the country. It was written by two dads who both hold MBA's. With two MBA's and 14 kids between them, they really are well qualified to put together this program.

_________________________________________________________

So...the big questions:

What did Mom think of the program?

- I loved it. My kids are a great age for these lessons. The online program is amazing and supports the work book pages and concepts taught within. The kids love punching in their allowance every week and watching the progress bar grow when the money transfers into their account. "MOM! Look how much closer I am NOW!" I've even had an easier time with their extra reading because they know when they finish those books, they'll have some extra money to go towards their goals.

- It really is step-by-step!

- My mind whirls with the possibilities this curriculum has. I could easily see using these workbooks in a co-op setting and drawing the program out into a full semester class. Each family would need to purchase their own combo pack, but you could teach multiple grade levels with the materials included.

- This is a great product for any family, even if you're not homeschooling. It's also great for scouts trying for their Financial Merit Badges. It aligns with JumpStart National Standards for K-12 Personal Finance Education.

- It's simple, concise and I haven't seen much like it even though I have been looking for a way to teach money smarts to my kids.

- It has great instructions. Great support from the publishers. A fabulous blog that gives tips for helping your kids (FamilyMint Blog).

Would I change anything?

- If the program is supposed to take 2 months, I might like the lessons broken down into more than 4 lessons. I know, I can make each lesson take two weeks. Breaking it into 8 Lessons might work better for disorganized moms like me.

- I would have liked a small section of discussion about wants vs needs. We discussed it on our own, but I could easily see how it would fit snuggly into the rest of the curriculum.

What did Emma (8) think of the program?

What did Matthew (11) think of the program?

- "I think it's great! I liked learning about setting goals and making them SMART! My favorite part was finding all my money and counting it up to put in my account."

- "I think it is excellent so far. The workbook showed me how to balance my income from my expenses and that I should save a little of my allowance for the future each week. My favorite part was the goal setting system and then putting it on the on-line app. I liked how I could set a percentage of my money from allowance to go to each goal. It was cool how when I set up a goal, it would estimate how much money I had to save each week to meet my goal in the time I set."

#MosaicReviews #FamilyMint #FilledwithCrazy #homeschool